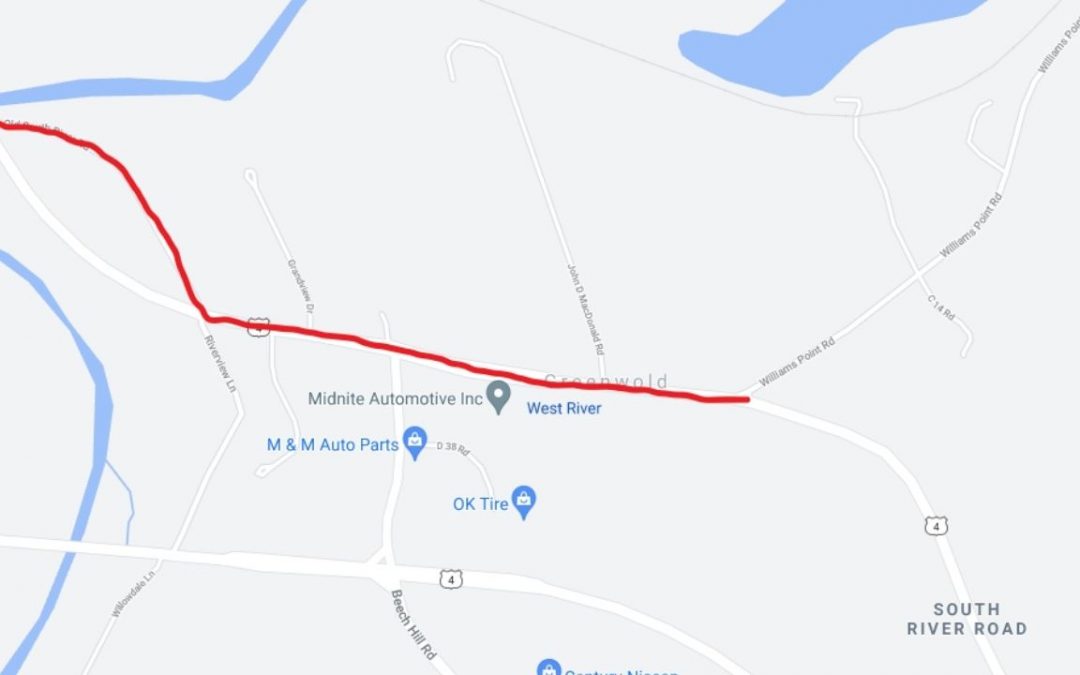

The Municipality of the County of Antigonish is seeking proposals for the Appleseed Drive Waterline Extension.An information package on this Request for Proposals is available at the Municipal Public Works Building, 261 Beech Hill Road, Antigonish or by following the...