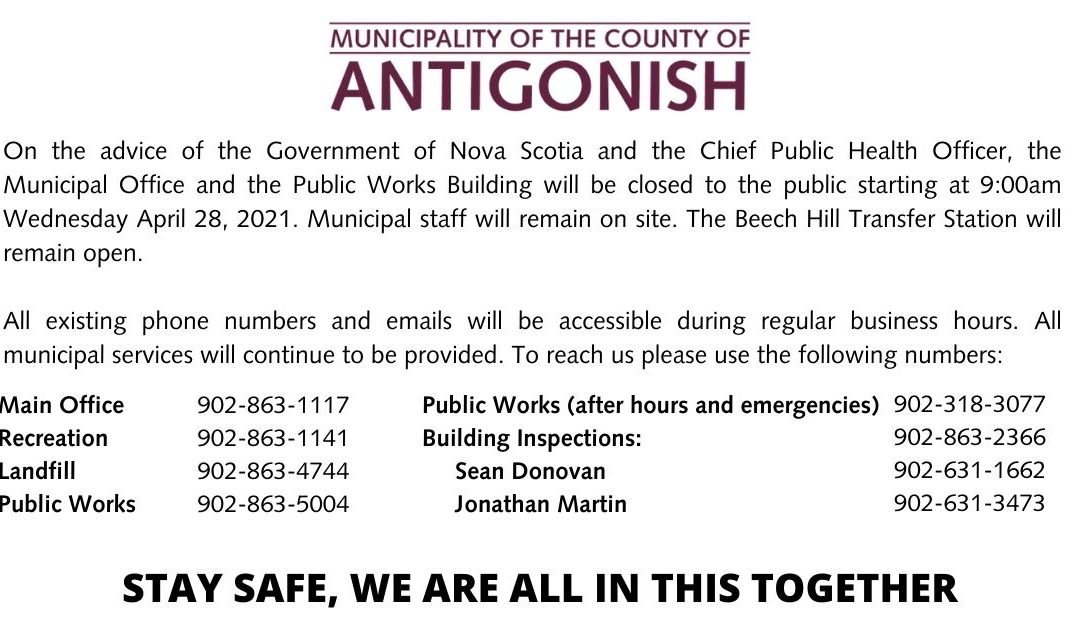

On the advice of the Government of Nova Scotia and the Chief Public Health Officer, the Municipal Office and the Public Works Building will be closed to the public starting at 9:00am Wednesday April 28, 2021. Municipal staff will remain on site. The Beech Hill...

Municipal and Public Works Office Closure

read more